Is Rental Equipment A Tax Write Off . when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable. You take the amount of the expense and subtract that from your taxable. you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. the irs allows you to deduct equipment you rent for business purposes from your taxes. the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. You can report the rentals with. The answer to the question, is rent tax deductible is an open. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. section 179 deduction:

from moussyusa.com

you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. the irs allows you to deduct equipment you rent for business purposes from your taxes. the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. The answer to the question, is rent tax deductible is an open. You can report the rentals with. You take the amount of the expense and subtract that from your taxable. section 179 deduction: when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable.

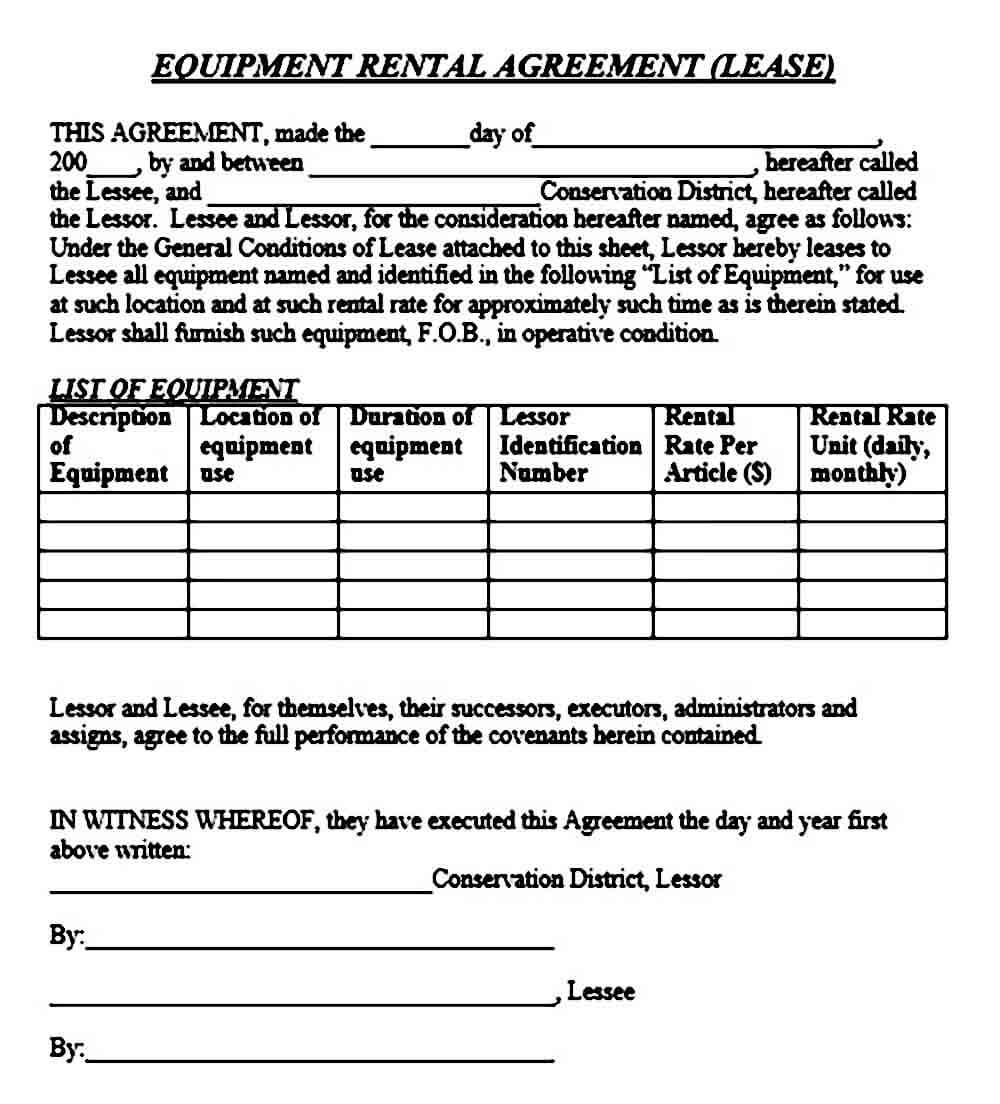

Equipment Rental Agreement Sample Mous Syusa

Is Rental Equipment A Tax Write Off the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. section 179 deduction: the irs allows you to deduct equipment you rent for business purposes from your taxes. you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. You can report the rentals with. The answer to the question, is rent tax deductible is an open. You take the amount of the expense and subtract that from your taxable. when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable.

From moussyusa.com

Equipment Rental Agreement Sample Mous Syusa Is Rental Equipment A Tax Write Off the irs allows you to deduct equipment you rent for business purposes from your taxes. the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. You can report the rentals with. The answer to the question, is rent tax deductible is an open. You take the amount of the expense and subtract that. Is Rental Equipment A Tax Write Off.

From invoicemaker.com

Equipment Rental Invoice Template Invoice Maker Is Rental Equipment A Tax Write Off when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable. the irs allows you to deduct equipment you rent for business purposes from your taxes. You can report the rentals with. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your. Is Rental Equipment A Tax Write Off.

From www.wordtemplatesonline.net

24 Free Equipment Rental Agreement Forms (Editable Template) Is Rental Equipment A Tax Write Off The answer to the question, is rent tax deductible is an open. you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. the irs allows you to deduct equipment you rent for business purposes from your taxes. when you lease equipment for. Is Rental Equipment A Tax Write Off.

From juro.com

Equipment lease agreement template free to use Is Rental Equipment A Tax Write Off you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. The answer to the question, is rent tax deductible is an open. when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable. You take. Is Rental Equipment A Tax Write Off.

From oakenequipment.ca

BillC19 Is The Largest Ever Tax Deduction Oaken Equipment Is Rental Equipment A Tax Write Off you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. section 179 deduction: You can report the rentals with. The answer to the question, is rent tax deductible is an open. the irs provides specific guidelines and rules regarding the deductibility of. Is Rental Equipment A Tax Write Off.

From fabalabse.com

Why is rent not tax deductible? Leia aqui Can I claim rent as a tax Is Rental Equipment A Tax Write Off when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable. You take the amount of the expense and subtract that from your taxable. the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. you can deduct equipment lease payments on your taxes as. Is Rental Equipment A Tax Write Off.

From www.pinterest.com

Is Rental Property a Tax WriteOff? Morris Invest Rental property Is Rental Equipment A Tax Write Off section 179 deduction: You take the amount of the expense and subtract that from your taxable. when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. you can deduct. Is Rental Equipment A Tax Write Off.

From fabalabse.com

Can I write off apartment rent on taxes? Leia aqui Does paying rent Is Rental Equipment A Tax Write Off the irs allows you to deduct equipment you rent for business purposes from your taxes. section 179 deduction: You can report the rentals with. when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable. the irs provides specific guidelines and rules regarding the deductibility of rent expenses. Is Rental Equipment A Tax Write Off.

From blog.turbotax.intuit.com

What is a Tax WriteOff? The TurboTax Blog Is Rental Equipment A Tax Write Off the irs allows you to deduct equipment you rent for business purposes from your taxes. the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. section 179 deduction: if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. when you lease equipment. Is Rental Equipment A Tax Write Off.

From templatelab.com

44 Simple Equipment Lease Agreement Templates ᐅ TemplateLab Is Rental Equipment A Tax Write Off You take the amount of the expense and subtract that from your taxable. section 179 deduction: You can report the rentals with. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce. Is Rental Equipment A Tax Write Off.

From templatepdf.blogspot.com

Equipment Rental Agreement Template Pdf PDF Template Is Rental Equipment A Tax Write Off if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. You can report the rentals with. the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. The answer to the question, is rent tax deductible is an open. the irs allows you to deduct. Is Rental Equipment A Tax Write Off.

From efinancemanagement.com

Accounting for Equipment Lease Meaning, Treatment, and Example eFM Is Rental Equipment A Tax Write Off the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. You take the amount of the expense and subtract that from your taxable. you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. the irs allows you. Is Rental Equipment A Tax Write Off.

From fabalabse.com

How much can you write off rent? Leia aqui Can I use my rent as a tax Is Rental Equipment A Tax Write Off You can report the rentals with. The answer to the question, is rent tax deductible is an open. the irs allows you to deduct equipment you rent for business purposes from your taxes. you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract.. Is Rental Equipment A Tax Write Off.

From morrisinvest.com

Is Rental Property a Tax WriteOff? Morris Invest Is Rental Equipment A Tax Write Off the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. You can report the rentals with. The answer to the question, is rent tax deductible is an open. the irs allows you to deduct equipment you rent for business purposes from your taxes. when you lease equipment for your business, you’re often. Is Rental Equipment A Tax Write Off.

From www.sampletemplates.com

FREE 15+ Sample Equipment Rental Agreement Templates in PDF MS Word Is Rental Equipment A Tax Write Off if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. You can report the rentals with. when you lease equipment for your business, you’re. Is Rental Equipment A Tax Write Off.

From fabalabse.com

Can I write off the rent I pay? Leia aqui Can I use my rent as a tax Is Rental Equipment A Tax Write Off when you lease equipment for your business, you’re often eligible for certain tax deductions that can reduce your taxable. section 179 deduction: you can deduct equipment lease payments on your taxes as rent — as long as you actually have a lease, not a conditional sales contract. the irs provides specific guidelines and rules regarding the. Is Rental Equipment A Tax Write Off.

From www.typecalendar.com

Free Printable Equipment Lease Agreement Templates [Word, PDF] Is Rental Equipment A Tax Write Off the irs provides specific guidelines and rules regarding the deductibility of rent expenses for businesses. The answer to the question, is rent tax deductible is an open. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. when you lease equipment for your business, you’re often eligible for certain. Is Rental Equipment A Tax Write Off.

From help.taxreliefcenter.org

How To Write Off Taxes On Rental Property Tax Relief Center Is Rental Equipment A Tax Write Off section 179 deduction: You can report the rentals with. the irs allows you to deduct equipment you rent for business purposes from your taxes. if your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental. You take the amount of the expense and subtract that from your taxable. when. Is Rental Equipment A Tax Write Off.